Tailored Digital Identity Protection for Credit Unions

Discover Fraud Prevention Strategies Your Members Can Bank On

Credit unions are increasingly prime targets for cybercrime, facing disproportionate risk compared to larger banks due to limited in-house security resources and rising digital expectations. With the average cost of a breach now exceeding $5.9 million, the consequences can be devastating—damaging both reputation and member trust.

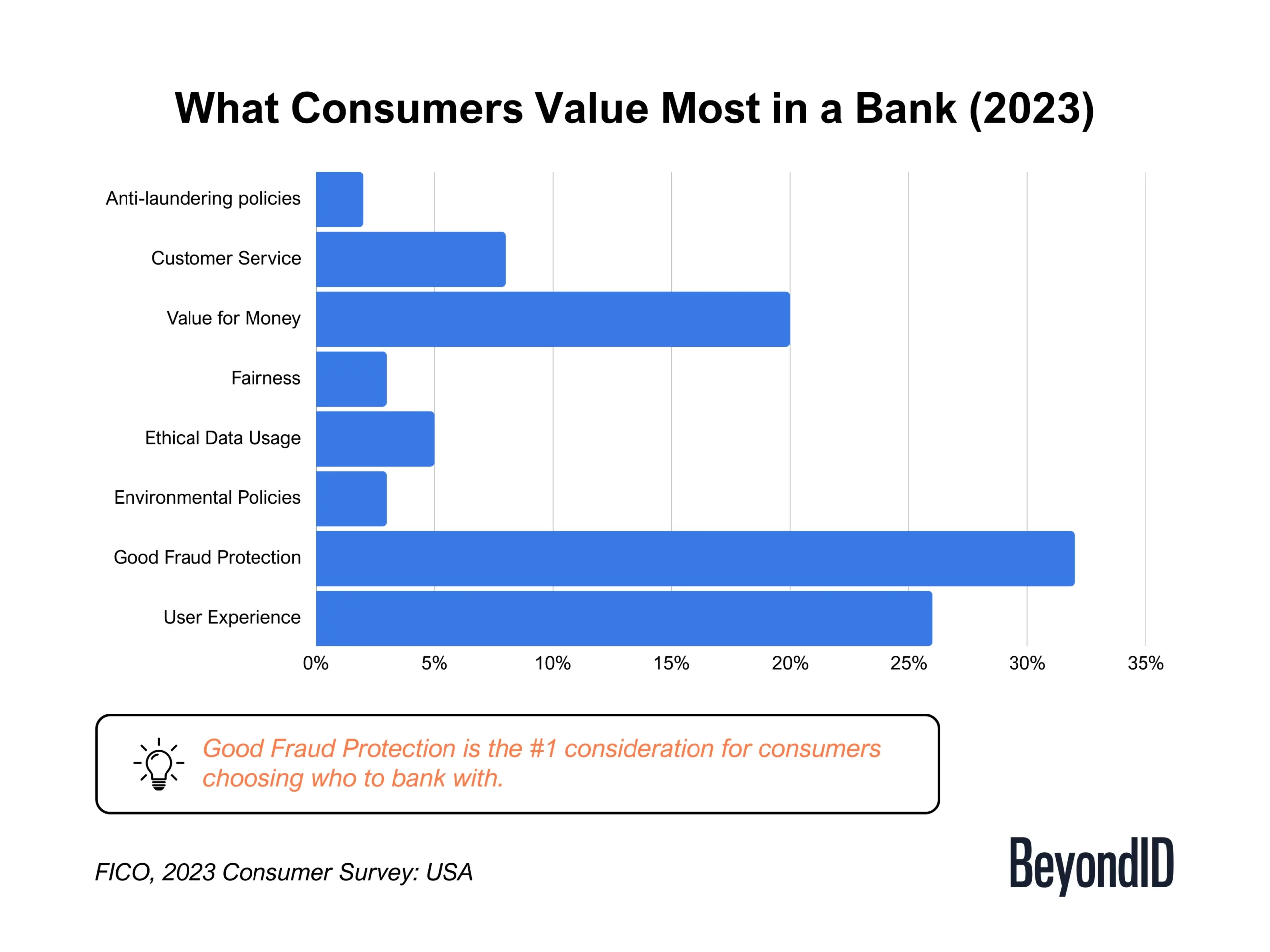

Today, fraud protection isn’t just a nice-to-have; it’s the top decision factor for banking customers. Yet many credit unions still lack the layered, identity-first security strategies needed to combat evolving threats. That’s where BeyondID steps in—helping close the gap between risk and resilience without compromising member experience.

The War Against Fraud: Safeguard Your Workforce and Customers

Safeguard your organization from fraud with expert-driven insights. Download our free eBook to learn more about enhancing your fraud prevention strategy with identity.

Featured Resources

Ready to Unlock the Full Promise of Identity?

Few cybersecurity firms are wholly focused on identity, providing strategic advisory, implementation, and 24×7 monitoring and support. Discover the difference with BeyondID — your success story starts here.

IAM Insights, Straight to Your Inbox

Sign up for the latest news, curated resources, and fresh industry perspectives.